# businessowner

3 posts in `businessowner` tag

Breaking: Presumptive Taxation Moves to Section 58 - Complete Guide

The Income Tax Act 2025 introduces Section 58, replacing Section 44AD for presumptive taxation of small businesses. This provision applies to eligible assessees with turnover up to ₹2-3 crore, offering simplified tax computation at 6% for digital transactions and 8% for other receipts, or actual profit—whichever is higher. The change promotes digital payments and reduces compliance burden for small businesses while maintaining revenue collection efficiency.

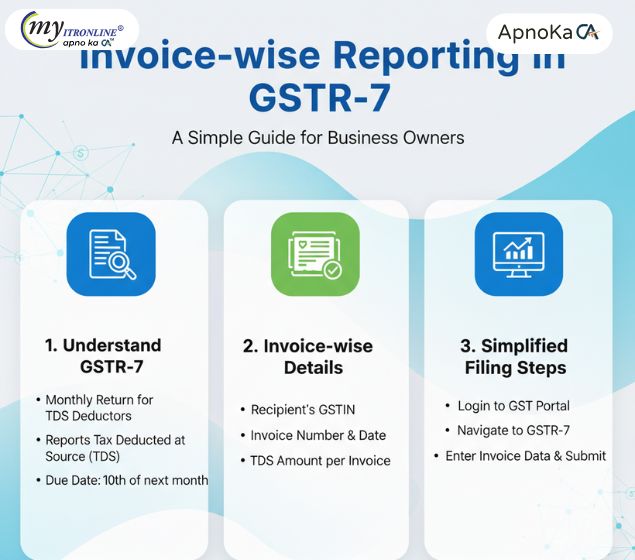

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

Section 142(1) of the Income Tax Act

Section 142(1) of the Income Tax Act empowers the Assessing Officer to issue notices to taxpayers in certain situations to obtain more information or clarification before completing the tax assessment. This blog provides a comprehensive understanding of Section 142(1), including when the AO can issue a notice, the information that can be sought, the consequences of non-compliance, and the steps taxpayers should take to respond effectively. It also highlights the safeguards in place to prevent misuse and ensure fairness in the tax assessment process. By understanding their rights and obligations under Section 142(1), taxpayers can navigate the tax assessment process more effectively and avoid potential penalties.