# business

12 posts in `business` tag

ICAI Eases Financial Reporting for Non-Corporate Entities & LLPs in FY 2024-25

The Institute of Chartered Accountants of India (ICAI) has announced a significant, temporary compliance relaxation for non-corporate entities and Limited Liability Partnerships (LLPs) for the Financial Year 2024-25. This allows these entities to optionally adopt updated guidance notes on financial statements, aiming to reduce administrative burden while maintaining transparency and accuracy. This flexibility ensures that core accounting standards remain paramount, offering businesses a choice in their reporting approach for the upcoming fiscal year.

Big Changes Coming to GST on October 1, 2025: What Your Business Needs to Know

The Indian government has announced significant GST updates, effective October 1, 2025, stemming from the Finance Act, 2025. These amendments will impact definitions, voucher taxation, Input Tax Credit (ITC) on plant & machinery (retrospectively from 2017), return filing procedures, appeal processes, and introduce a new 'track & trace' system with associated penalties. Businesses must prepare for these changes by reviewing operations, updating systems, and training staff to ensure compliance and manage potential cash flow implications.

Big News for Small Businesses: Say Goodbye to Annual GST Returns (GSTR-9) From FY 2024-25!

This blog post announces a significant and permanent change in GST compliance for small businesses in India. From Financial Year 2024-25, businesses with an annual aggregate turnover of up to 2 crore are exempt from filing the annual GST return (Form GSTR-9). The article details what changed, who benefits, and the tangible advantages like time and cost savings. It also highlights crucial reminders about continued monthly/quarterly filings, record-keeping, and turnover monitoring. The post emphasizes that this move will greatly enhance the "Ease of Doing Business" for millions of small enterprises.

GST on Bricks: Understanding the Latest Rules

This blog post clarifies the latest GST rules for bricks in India, effective September 22, 2025. It details the two tax options for most brick types (6% without ITC under composition scheme or 12% with ITC under regular scheme) and introduces a special 5% GST rate with ITC for sand-lime bricks, which cannot opt for the composition scheme. The article also highlights the crucial annual turnover threshold of ₹20 lakh for GST registration. It explains the importance of these changes, who is affected, the pros and cons, and provides actionable advice for businesses, including checking turnover, correct brick classification, scheme selection, pricing adjustments, and record-keeping. Finally, it discusses the implications for buyers and builders and outlines potential issues such as classification disputes and transitional challenges.

Big News! GST Rate Changes Are Coming Soon

This blog post announces significant changes to Goods and Services Tax (GST) rates in India, set to become effective from September 22, 2025, as per Notification No. 09/2025 – Central Tax (Rate). It provides a clear, simplified table comparing old and new rates for categories like household essentials, packaged food, luxury goods, hospitality, travel, professional consultancy, and IT services. The post highlights the implications for businesses (updating systems for compliance) and consumers (potential price changes), emphasizing the government's aim for clarity and easier compliance. It concludes by advising consultation with tax professionals for specific sector-related queries.

194J vs. 44AD: Tax Scrutiny on India's Content Creators & Consultants

This blog post addresses the increasing tax notices faced by Indian content creators, influencers, and consultants due to a common mismatch: clients deducting TDS under Section 194J while they file income tax returns under Section 44AD. It breaks down the key tax provisions (194J, 44AD, 44ADA), explaining what each means for freelancers and businesses. The article clarifies that a 194J deduction doesn't automatically mandate filing under 44ADA; the crucial factor is whether the profession is listed under Section 44AA. It details potential impacts on tax burden, cash flow, and the need for increased documentation, while also offering actionable steps for creators and consultants to ensure compliance, including clarifying work nature, maintaining records, client communication, cash flow monitoring, and seeking professional tax advice.

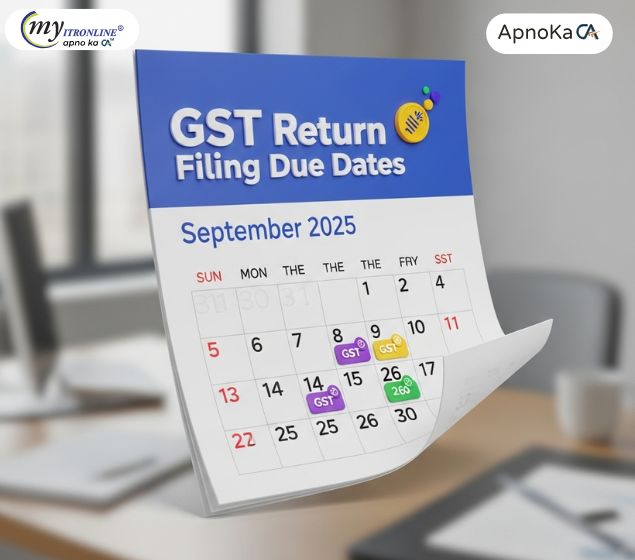

GST Return Filing Due Dates in September 2025

This quick-reference guide lays out all key GST return due dates for September 2025 — including deadlines for GSTR-7, GSTR-8, GSTR-1, IFF (QRMP), GSTR-6, GSTR-5, GSTR-3B and GSTR-5A — plus practical notes on why on-time filing matters and a simple table you can use as a checklist.

GST Rate Changes: Your Essential Guide to Stock ITC Recovery & Reversal

This blog post provides a comprehensive guide to the upcoming GST rate changes in India, effective 22 September 2025, focusing specifically on the implications for Input Tax Credit (ITC) on stock. It explains the new simplified tax slab structure (5%, 18%, 40% for luxury goods) and details how businesses should handle ITC for stock purchased before the changes, supplies made after the changes, and unsold old inventory. The post offers practical advice on identifying stock, claiming eligible ITC, reversing ITC where necessary, seeking manufacturer support, and maintaining audit-ready records to navigate this significant tax transition effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

.jpg)

Income Tax Depreciation Rates for FY 2025-26 (AY 2026-27): The Complete Guide

A comprehensive guide for businesses on the depreciation rates and rules applicable for the Financial Year 2025-26 under the Indian Income Tax Act. The blog details the core principles, including the 'Block of Assets' concept and the WDV method. It provides a clear breakdown of depreciation rates for various asset classes like buildings, machinery, and intangible assets. Furthermore, it covers crucial special provisions such as additional depreciation for manufacturing units, rules for the sale of assets, and recent updates like the non-depreciable status of goodwill, empowering businesses with the knowledge for effective tax planning and compliance.

.jpg)

Set Off and Carry Forward of Losses: A Detailed Explanation

This blog provides a comprehensive explanation of the provisions for setting off and carrying forward losses under the Indian Income Tax Act. It details the process of adjusting financial losses against profits to reduce the overall tax burden. The article breaks down the two primary methods: intra-head and inter-head set-off, outlining the specific rules and restrictions for various types of losses, including business loss, capital loss, and loss from house property. It also covers the crucial conditions and timelines for carrying forward unadjusted losses to future years, making it an essential guide for taxpayers looking to optimize their tax planning for the Assessment Year 2025-26.