# ay2025

12 posts in `ay2025` tag

Foreign Assets Alert: Avoid Heavy Penalties by Updating Returns

The Income Tax Department has warned about 25,000 taxpayers to review and revise AY 2025-26 returns for foreign assets and income by December 31, 2025. Non-reporting can lead to a 10 lakh fine and up to 300% penalty. Last year’s drive led to major disclosures. Act now to stay compliant.

Income Tax Return & Audit Report Deadlines Extended for AY 2025–26

The Central Board of Direct Taxes (CBDT) has extended the deadlines for filing Income Tax Returns and audit reports for the Assessment Year 2025–26. This move offers relief to taxpayers and professionals by giving them more time to complete their filings.

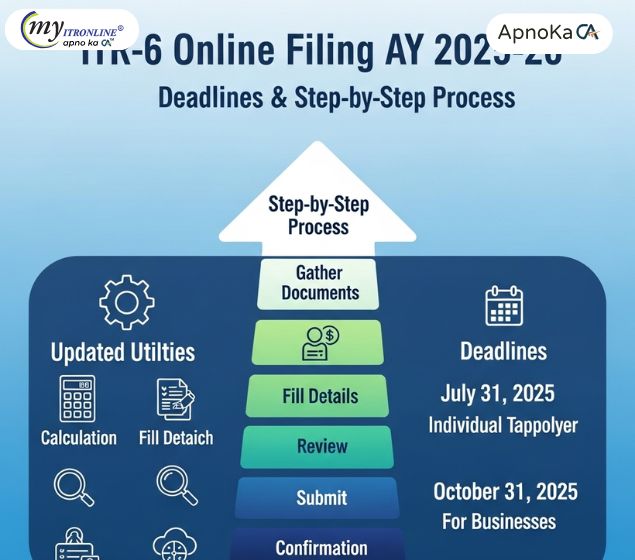

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

Didn’t File ITR by September 16? Here’s What You Can Still Do

This blog post provides a comprehensive guide for individuals who have missed the September 16, 2025, deadline for filing their Income Tax Return (ITR) for FY 2024-25. It reassures readers that filing is still possible through a "belated return" by December 31, 2025, but outlines the associated penalties, including late filing fees (₹1,000 or ₹5,000) and interest on unpaid tax. The article also details other consequences of late filing, such as the inability to carry forward certain losses, delayed refunds, and potential loss of specific deductions. It touches on rare exceptions and what happens if even the belated deadline is missed. Finally, it offers practical advice to act promptly, gather documents, compute accurately, and seek professional help, promoting MyITROnline as a solution for simplified tax filing.

Due Date for Filing ITRs AY 2025-26 Extended Again

The Income Tax Department has granted a crucial one-day extension for filing Income Tax Returns for Assessment Year 2025-26, pushing the final deadline to September 16, 2025. This extension aims to assist taxpayers who encountered issues with the e-filing portal. This is a final opportunity to avoid penalties, so file your ITR promptly with myITRonline.

Our Success Enablers: Key Highlights of ITR Filing for AY 2025-26

This blog post provides a detailed overview of the key highlights from the Income Tax Return (ITR) filing season for Assessment Year (AY) 2025-26, as of September 8, 2025. It showcases significant statistics including over 13.36 crore registered users, more than 5 crore returns filed, nearly 4.72 crore verified returns, and over 3.39 crore processed returns. The post emphasizes the growing trust in the e-filing platform, faster processing times, and the success of India's digital transformation in tax administration, positioning the Income Tax Department as "Success Enablers."

Tax Relief: CBDT Extends ITR & Audit Report Due Dates for AY 2025-26

This blog post details the Central Board of Direct Taxes' (CBDT) extension of due dates for filing Income Tax Returns (ITRs) and tax audit reports for Assessment Year (AY) 2025-26. It explains the reasons behind the extension, provides a clear table of new deadlines for various taxpayer categories (individuals, audit cases, and transfer pricing cases), and discusses why tax professionals are still advocating for further extensions. The post also outlines the penalties and interest associated with missing these extended deadlines, including fees under Section 234F and interest under Section 234A. Finally, it offers practical advice for taxpayers to ensure timely compliance.

.jpg)

AY 2025-26 ITR Filings Cross 3.29 Crore; Over 1.13 Crore Already Processed

Despite the ITR filing deadline for AY 2025-26 being extended to September 15, over 3.29 crore returns have already been filed by mid-August, with 1.13 crore processed. This highlights growing tax compliance and the Income Tax Department's processing efficiency.

ITR-6 Excel Utility for AY 2025-26 is Live: What Corporate Filers Need to Know

This blog announces the release of the ITR-6 Excel Utility for the Assessment Year 2025-26 by the Income Tax Department. It details which companies are required to file this form, highlights key updates and changes for this year (such as LEI and capital gains reporting), provides a step-by-step guide on how to use the offline utility, and clarifies the important filing deadlines to help corporate filers ensure timely and accurate compliance.

.jpg)

Oops! Did You Make an ITR Mistake? Here's How to Easily File a Revised Return

Made an error on your Income Tax Return? Don't stress! This comprehensive guide walks you through the process of filing a Revised Return under Section 139(5) for Assessment Year 2025-26. Learn common reasons for revision, key deadlines, and a simple step-by-step online process to ensure your tax records are accurate and penalty-free.