# audit

12 posts in `audit` tag

Internal Audit Goes Digital: The Race for Real-Time Assurance

Internal audit is changing fast. The old yearly audit model is no longer enough in today’s business world of massive data, instant transactions, and rising cyber threats. Companies now face complex fraud and faster risks, which means audit teams must adopt technology to provide real-time assurance. With tools like AI, data analytics, RPA, and blockchain, audits can detect risks instantly, prevent losses, and give management real-time insights. By building a clear technology roadmap, upskilling auditors, and focusing on business value, internal audit can move beyond compliance to become a strategic partner that strengthens risk management and supports smarter decisions.

Income Tax Return & Audit Report Deadlines Extended for AY 2025–26

The Central Board of Direct Taxes (CBDT) has extended the deadlines for filing Income Tax Returns and audit reports for the Assessment Year 2025–26. This move offers relief to taxpayers and professionals by giving them more time to complete their filings.

MCA Extends CRA-4 Filing Deadline No Extra Fee Till 31st December 2025

The Ministry of Corporate Affairs (MCA) has extended the deadline for CRA-4 filing without extra fees till 31st December 2025. This move helps companies and cost auditors adjust to the new form rollout on the MCA V3 portal and avoid penalties.

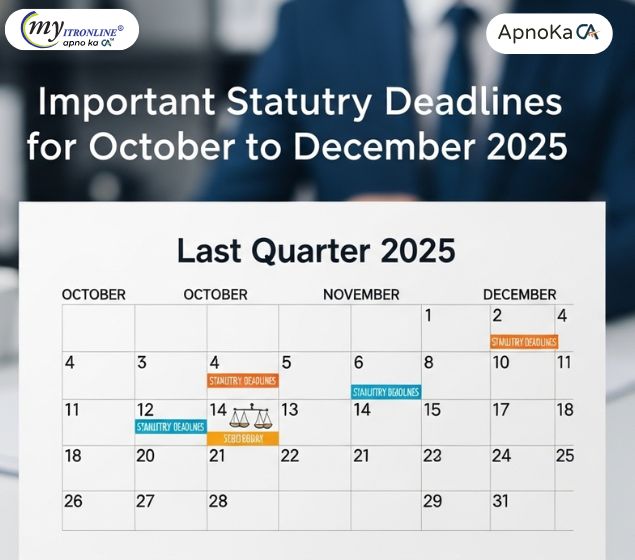

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

ITR Filing Deadline Extended: Relief for Tax Audit Cases

The Gujarat High Court has directed the CBDT to extend the Income Tax Return (ITR) filing deadline for tax audit cases from October 31 to November 30, 2025. This move provides much-needed relief to taxpayers and professionals, allowing more time for accurate filing and reducing stress.

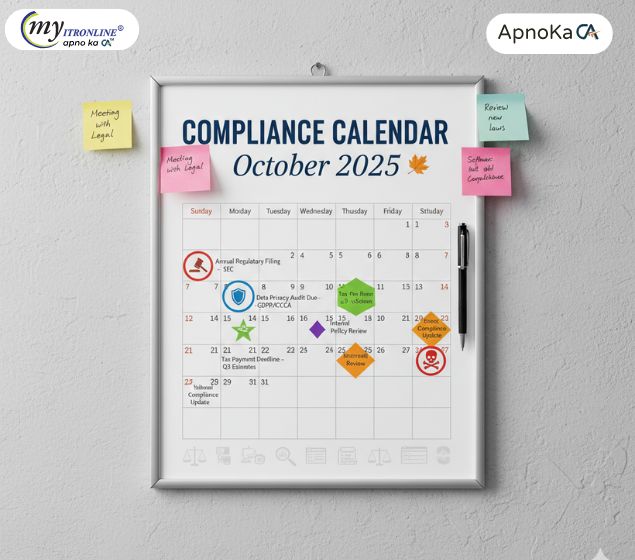

Compliance Calendar October 2025 – Key Tax and Regulatory Deadlines

October 2025 is packed with critical tax and regulatory deadlines. This blog highlights key dates for income tax, GST, MCA filings, EPF/ESI contributions, and audit-related submissions to help you stay compliant and avoid penalties.

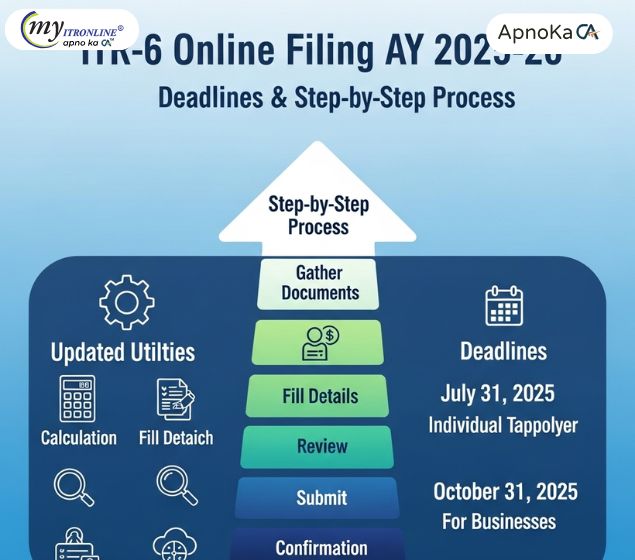

ITR-6 Online Filing AY 2025-26: Updated Utilities, Deadlines & Step-by-Step Process

The Income Tax Department has enabled online filing of ITR-6 for Assessment Year 2025-26, along with updated offline utilities. All companies except those claiming Section 11 exemption must file by the specified deadlines. This comprehensive guide covers eligibility, filing steps, critical deadlines, and common errors to avoid for seamless compliance

Relief for Taxpayers: Gujarat HC Pushes for ITR Deadline Shift

In a major relief for taxpayers and professionals, the Gujarat High Court has directed CBDT to extend the ITR filing deadline for audit-case assessees to 30th November 2025, aligning it with the tax audit timeline.Gujarat High Court Directs CBDT to Extend ITR Filing Deadline

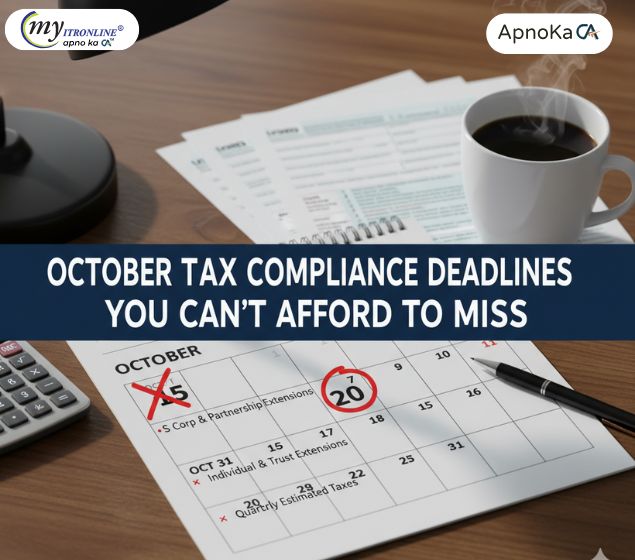

October Tax Compliance Deadlines You Can’t Afford to Miss

October is a crucial month for tax professionals and businesses in India, with multiple compliance deadlines across GST, TDS/TCS, ROC filings, income tax returns, and employee contributions. This blog provides a clear and actionable checklist to help you stay compliant, avoid penalties, and manage your filings efficiently.

CBDT Revises Tax Audit Deadline to 31st October 2025

CBDT has extended the deadline for filing Tax Audit Reports for AY 2025–26 to 31st October 2025. This move provides relief to professionals and businesses facing compliance pressure. Stakeholders are advised to file promptly and stay informed via official channels.

Request for Extension of Income Tax Filing Deadlines for AY 2025–26

Due to persistent technical issues with the Income Tax portal and delayed release of filing utilities, MP P.C. Gaddigoudar has formally requested the Finance Ministry to extend the due dates for filing returns and audit reports under Section 139(1) and 3CA/3CB-3CD for AY 2025–26. This blog highlights the proposed changes and why they matter to professionals and small businesses.

ICAI Eases Financial Reporting for Non-Corporate Entities & LLPs in FY 2024-25

The Institute of Chartered Accountants of India (ICAI) has announced a significant, temporary compliance relaxation for non-corporate entities and Limited Liability Partnerships (LLPs) for the Financial Year 2024-25. This allows these entities to optionally adopt updated guidance notes on financial statements, aiming to reduce administrative burden while maintaining transparency and accuracy. This flexibility ensures that core accounting standards remain paramount, offering businesses a choice in their reporting approach for the upcoming fiscal year.