# apnokaca

12 posts in `apnokaca` tag

UIDAI Ends Aadhaar Photocopy System and Moves to Digital Verification

UIDAI is ending the use of Aadhaar photocopies to improve security and protect user privacy. Aadhaar verification will now be done only through QR codes and the new Aadhaar App. Businesses must register with UIDAI and use digital verification methods, and citizens are encouraged to stop sharing physical photocopies.

Madras High Court Offers Big Relief to Tyre Companies on GST Penalties

The Madras High Court has cancelled major tax notices issued to Apollo Tyres Ltd. and MRF Ltd., ruling that voluntary tax payment cannot trigger the harsh penalties under Section 74. The court clarified that when confusion exists in the industry and companies show willingness to pay, the case falls under Section 73 for genuine mistakes. This decision offers clarity and relief to businesses facing similar disputes.

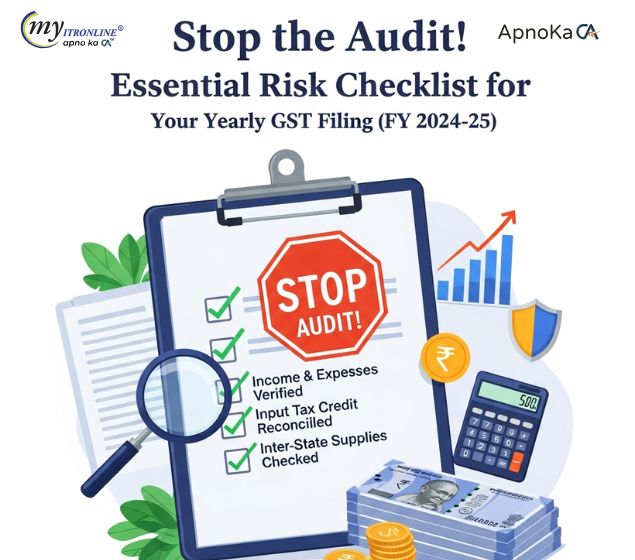

Stop the Audit! Essential Risk Checklist for Your Yearly GST Filing (FY 2024-25)

Simplify your year-end tax process. This guide cuts through the complexity of the annual GST return (GSTR-9) and highlights 25 critical errors the 'Red Flags' that often trigger government scrutiny. Use this checklist to safeguard your business before the deadline.

New ITR Forms for AY 2026–27 Announced: Key Updates Taxpayers Should Know

The Government will soon release simplified ITR forms for AY 2026–27, aligned with the new Income-tax Act, 2025. These updated forms aim to make filing easier, reduce compliance burden, and reflect changes expected in Budget 2026. Here’s a quick, clear overview for taxpayers.

How to File GSTR-9 for FY 2023-24 with Late Entries in FY 2024-25

Filing GSTR-9 for FY 2023-24 can be confusing if you recorded some entries in FY 2024-25. This guide shows where to report late ITC, missed sales/debit notes, credit notes, and reverse charge so your annual return is accurate.

GST Demand Alert: Delhi HC Cancels Duplicate Notices

The Delhi High Court has cancelled duplicate GST demand notices (DRC-07) raised for the same transaction across different financial years, confirming that tax can only be demanded for the year in which the transaction occurred.

Understanding Section 112A: Tax Rules for Equity Investors

Section 112A of the Income Tax Act governs taxation of long-term capital gains on listed equity shares, equity-oriented mutual funds, and business trust units. It provides exemption up to 1,00,000 and levies 10% tax beyond that, without indexation benefit.

New GST Rule December 2025: No Bank Details = No GSTR-3B Filing

Starting December 2025, GST registrations will face automatic suspension if bank account details are not updated within 30 days or before filing GSTR-1/IFF. This new compliance rule directly impacts filing, billing, and business continuity, making timely updates essential for businesses.

GSTR-9 Annual Return FY 2024-25: Avoid Scrutiny with This Checklist

A clear, practical checklist for filing GSTR‑9 for FY 2024‑25. Covers revenue matching, ITC accuracy, RCM compliance, import alignment, reconciliation, and common filing pitfalls to help avoid scrutiny and penalties.

GSTR-9 Exemption for Small Businesses: Latest Update Explained

The government has permanently exempted businesses with turnover up to 2 Crores from filing GSTR-9. The move aims to reduce compliance burden while ensuring monthly and quarterly GST filings continue.

GST Update: Auto Suspension for Not Updating Bank Details

Starting 5th December 2025, businesses registered under GST must update their bank account details within 30 days of registration or before filing GSTR-1/IFF, whichever is earlier. As per Rule 10A, failure to comply will result in automatic suspension of GST registration. The update process requires furnishing bank account number, IFSC code, and a cancelled cheque or bank statement via the GST portal. While OIDAR and NRTP taxpayers are exempt, OIDAR taxpayers with a representative in India must provide bank details. Timely compliance ensures uninterrupted GST registration and avoids cancellation proceedings.

Drive Electric, Save on Tax: A Simple Guide to Section 80EEB

A simple guide to Section 80EEB, explaining how individuals can save up to ₹1,50,000 annually on EV loan interest, eligibility rules, and how to claim the deduction under the old tax regime.