# apnoakca

9 posts in `apnoakca` tag

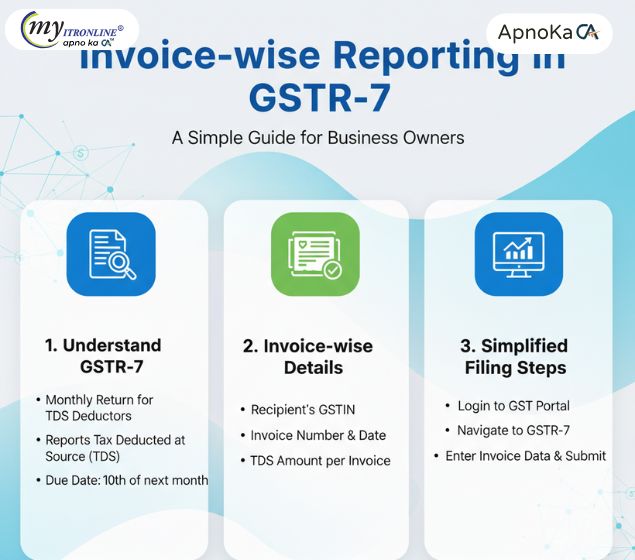

Invoice wise Reporting in GSTR-7: A Simple Guide for Business Owners

The GST portal now requires invoice wise reporting in Form GSTR-7 for all TDS deductors. This blog explains the change, its impact on deductors and suppliers, and provides a practical checklist to stay compliant and avoid mismatches.

CBDT Simplifies Tax Rules for IFSC Funds: A Major Win for Investors

This blog post breaks down the recent significant amendment made by the CBDT to Rule 21AIA of the Income Tax Rules. It details the removal of sub-rule (4), which previously imposed additional compliance burdens on "specified funds" like retail schemes and ETFs in the IFSC. The post explains how this change aligns tax laws with IFSCA regulations, effectively eliminating dual regulation. The primary impact is simplified compliance, reduced regulatory overlap, and a more attractive investment environment in India's IFSC, ultimately fostering growth in financial hubs like GIFT City.

.jpg)

Don't Get Penalized: The Essential Guide to TDS on Rent Above 50,000

This blog post provides a comprehensive guide for individuals and HUFs paying monthly rent above 50,000, highlighting their often-overlooked TDS obligations under Section 194-IB of the Income Tax Act. It details who is applicable, the current TDS rate (2% from Oct 2024, 5% earlier), deduction and deposit timelines (annual deduction, 30 days for deposit), and the use of Form 26QC and Form 16C. Crucially, the post emphasizes the severe consequences of non-compliance, including various interest charges, late filing fees (up to 200/day), substantial penalties (10,000-1,00,000), and even potential prosecution. It also offers actionable steps for compliance and guidance for those who have missed previous deductions, urging tenants to prioritize this crucial tax duty to avoid significant financial and legal repercussions.

Income Tax E-Filing: Aadhaar OTP Verification Becomes Mandatory – Your Essential Guide

This blog post details the recent mandatory implementation of Aadhaar OTP verification on the Income Tax e-Filing portal for ITR verification and other services. It explains the reasons behind this shift, focusing on enhanced security, streamlined processes, and data integration. The post outlines the crucial impact on taxpayers, emphasizing the necessity of PAN-Aadhaar linking and updated mobile numbers. It also provides actionable steps for those not yet ready and reiterates the benefits of this digital transformation for tax administration in India.

Don't Miss the Deadline: Vivad se Vishwas 2024 Ends April 30, 2025!

This blog post details the recently announced final deadline of April 30, 2025, for filing declarations under the Direct Tax Vivad se Vishwas Scheme, 2024 (VSV 2.0). It explains the scheme's purpose, eligibility criteria (including the expansion for certain cases), key benefits like waiver of interest/penalty, the procedural steps involving Forms 1-4, and urges eligible taxpayers to act before the deadline to resolve pending direct tax disputes.

TDS Rates for FY 2025-26: A Comprehensive Guide by Section with Threshold Limits

Detailed handbook on TDS rates for the financial year 2025-26 addressing Sections 194A (interest income), 194C (contractual payments), 194I (rental payments), 194J (professional services), and 194Q (purchase of goods). Contains information on threshold limits and requirements for PAN.

.jpg)

Regulatory & Tax Compliance Calendar for FY 2025-26: Important Due Dates

A detailed month-by-month overview of statutory deadlines for Income Tax, GST, TDS, PF, ESI, and ROC submissions in the fiscal year 2025-26 (April 2025–March 2026) to guarantee compliance and prevent penalties.

.jpg)

HRA Notice Alert! How to Respond and Prevent Future Issues

This detailed guide outlines the reasons taxpayers are issued HRA scrutiny notices, particularly for claims exceeding 5L. It also covers how to react by verifying claims, settling any unpaid TDS under Section 194IB, modifying ITR, and providing CA certificates to prevent penalties and future audits.

.jpg)

Taxpayers Alert: Budget 2025 Proposes a 70% Tax Hike on Updated ITRs

A substantial 70% extra tax on files after the two-year mark is the catch of the planned extension of the revised ITR filing term from two to four years in the Union Budget 2025. The goal of this action is to deter tax evasion and promote prompt compliance. This article examines the ramifications, professional viewpoints, and actions that taxpayers must take to avoid fines.