# advancetax

12 posts in `advancetax` tag

Why Your Tax Refund Reduced: The Interest You Didn’t Notice

This blog explains in simple language why taxpayers may have to pay extra interest if they delay filing their return, pay less tax during the year, or miss advance tax installments. It breaks down Sections 234A, 234B and 234C in an easy format and shares how timely payments can help avoid extra charges. If your final tax payable is less than ₹10,000, these rules normally do not apply.

December 2025 tax due dates: simple tracker for businesses and individuals

December is a crucial month for Indian taxpayers. This tracker lists the key dates for Income Tax (ITR, Advance Tax, TDS), GST (GSTR-1, IFF, GSTR-3B), and MCA filings, plus PF/ESI and TDS statements. Mark these deadlines to avoid late fees, interest, and ITC issues.

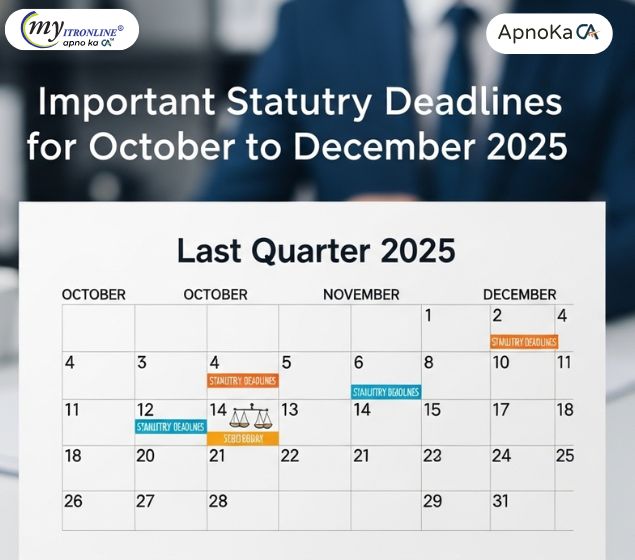

Important Statutory Deadlines for October to December 2025

A concise compliance calendar covering all major statutory deadlines from October to December 2025. Includes GSTR 3B, Tax Audit, ITR filings, TDS Q2, DIR 3 KYC, TP Audit, Advance Tax, ROC filings, and GST annual returns. Stay ahead and avoid penalties with this quick reference guide.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

A Trader's Guide to F&O Taxation: Decoding Your Income Tax Obligations

This guide explains the crucial aspects of Futures & Options (F&O) taxation in India. It clarifies that F&O income is categorized as 'Non-Speculative Business Income', detailing how to calculate turnover based on 'absolute profit' plus premiums. The guide outlines various deductible expenses to reduce taxable income and explains when a tax audit is mandatory, especially for losses or specific turnover thresholds. Finally, it covers how to manage F&O losses through set-off and carry-forward, and provides essential information on ITR filing (ITR-3), applicable tax rates, and advance tax payments, ensuring traders stay compliant and manage their finances effectively.

.jpg)

Understanding Interest Under Sections 234A, 234B, and 234C of the Income Tax Act

Sections 234A, 234B, and 234C of the Income Tax Act deal with interest charged for late filing of returns, underpayment, or deferment of advance tax. This blog explains each section in detail with examples and calculations, helping taxpayers stay compliant and avoid extra charge

India's Tax Report: Why a Small Drop is Actually Good News

This blog analyzes India's direct tax collections for FY 2025-26 (as of June 19, 2025). While net collections show a slight dip, the detailed breakdown reveals robust gross collection growth and a significant increase in tax refunds, reflecting enhanced taxpayer services. Positive advance tax figures further signal underlying economic strength and optimistic future expectations, painting a picture of resilience rather than slowdown

Advance Tax Guide for Presumptive Taxation Users (Sec 44AD/44ADA)

This blog explains how opting for presumptive taxation under Sections 44AD (businesses) and 44ADA (professionals) simplifies Advance Tax obligations, requiring only a single payment by March 15th instead of quarterly installments. It covers eligibility, calculation, and non-compliance consequences.

Avoid Penalties: The Advance Tax Guide for Indian Influencers (2025)

This guide explains the concept of Advance Tax and its applicability to Indian content creators (YouTubers, bloggers, influencers) for the Financial Year 2025-26. It details how to calculate the liability, discusses the Presumptive Taxation scheme (Sec 44AD/44ADA), outlines payment due dates and methods (Challan 280), explains penalties for non-compliance (Sec 234B/234C), and provides practical tips for creators to manage their tax obligations effectively.

.jpg)

Last Call for Advance Tax: Fourth Installment Deadline - March 15th, 2025 Explained

The fourth installment of Advance Tax is due March 15th, 2025. This blog explains what Advance Tax is, who is required to pay it, how to calculate it, and the implications of missing the deadline. Stay informed and avoid penalties by following our detailed advice.

.jpg)

TDS vs. Advance Tax: Essential Differences, Penalties, and Compliance Tips for Taxpayers

This blog discusses the fundamental distinctions between TDS (Tax Deducted at Source) and Advance Tax, as well as their application, payment schedules, and penalties for late payments. It also offers specific advice for taxpayers to stay compliant and avoid fines. Whether you're a salaried employee, freelancer, business owner, or investor, this guide will help you understand which taxes apply to you and how to handle your tax payments efficiently.

.jpg)

TDS Thresholds and Rationalization: What It Means for Your Cash Flow

This blog examines TDS rationalization in India, its effects on liquidity, and the advantages it offers to professionals, companies, and people. It discusses current developments, difficulties, and tax planning techniques for the 2025–2026 fiscal year.