# aadhaar

12 posts in `aadhaar` tag

UIDAI Ends Aadhaar Photocopy System and Moves to Digital Verification

UIDAI is ending the use of Aadhaar photocopies to improve security and protect user privacy. Aadhaar verification will now be done only through QR codes and the new Aadhaar App. Businesses must register with UIDAI and use digital verification methods, and citizens are encouraged to stop sharing physical photocopies.

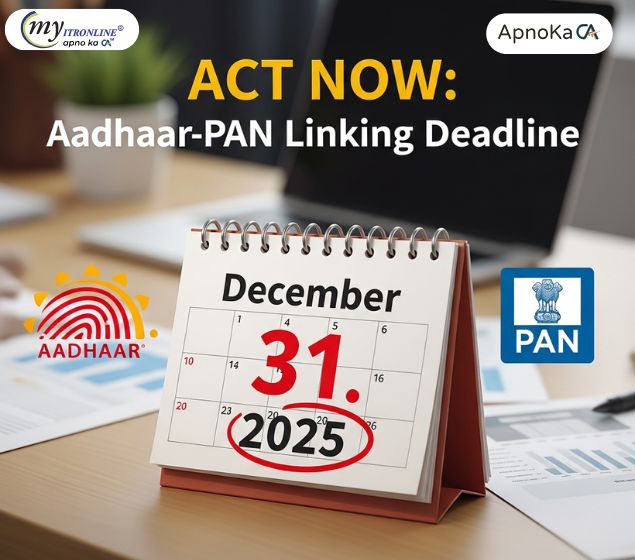

Act Now: Aadhaar-PAN Linking Deadline is December 31, 2025

Link your PAN with Aadhaar by December 31, 2025. If you miss the date, PAN goes inoperative from January 1, 2026, stopping ITR filing and blocking refunds. Pay 1,000 on the e-Filing portal and link now. Some groups are exempt.

Big News: Now Update Aadhaar Mobile Number From Home

UIDAI is rolling out a new feature in the Aadhaar App that allows users to update their Aadhaar-linked mobile number directly from home using OTP and face scan verification. The process is digital, simple, and includes a small fee of about ₹50 to ₹75.

UIDAI Removes 2 Crore Aadhaar Numbers to Stop Misuse

UIDAI has taken a big step to protect India’s identity system by deactivating over 2 crore Aadhaar numbers. Most of these numbers belonged to people who have passed away. The purpose is to prevent fraud and keep the Aadhaar system accurate and safe.

Why Your Tax Refund Is Delayed and What CBDT Wants You to Know

Many taxpayers are waiting for refunds, especially where the refund is large. The Central Board of Direct Taxes (CBDT) is closely checking high-value and flagged returns to stop fake claims and tax cheating. This guide explains the main reasons for delays, which cases get compulsory scrutiny, and simple steps you can take now to clear your refund faster.

EPFO Stops UAN Activation on Portal Here’s the New Way

EPFO has stopped UAN activation on its Member Sewa portal. The process is now available only through the UMANG App using Aadhaar-based Face Authentication. This ensures better security, fraud prevention, and smoother services.

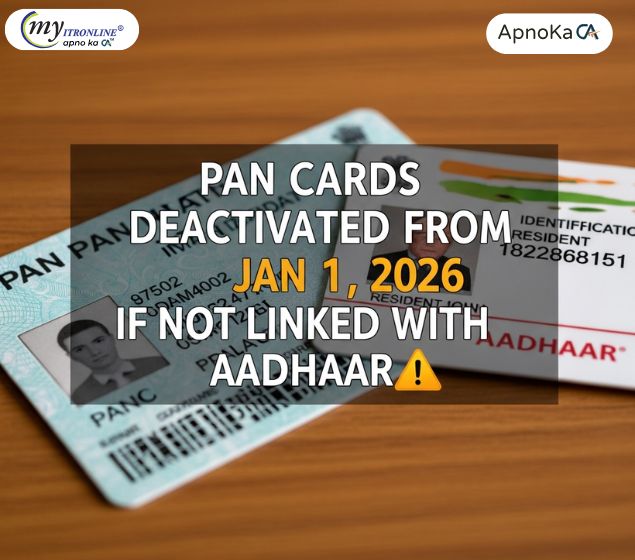

PAN Cards to Be Deactivated from January 1, 2026 If Not Linked with Aadhaar

The Indian government has set December 31, 2025, as the final deadline to link PAN cards with Aadhaar. Starting January 1, 2026, non-linked PANs will be deactivated, affecting tax filing, refunds, and financial services. Learn who needs to link, what happens if you don’t, and how to complete the process online or via SMS.

Quick GST Registration in 3 Days for Small Businesses

The GST portal has launched a faster registration process for low-risk taxpayers. With Aadhaar authentication and proper document upload, eligible applicants can now get GST registration within 3 working days.

GST Registration Made Easy: Rule 9A & Rule 14A

The Central Government has introduced two new GST rules—Rule 9A and Rule 14A—effective from November 1, 2025. These updates simplify and speed up the registration process for low-risk taxpayers and small B2B suppliers

PAN-Aadhaar Linking: CBDT Offers Major Relief on TDS Demand Notices (2025 Update)

In a major relief for Indian taxpayers, the Central Board of Direct Taxes (CBDT) has waived demands for short TDS deduction arising from payments to inoperative PAN holders. This addresses the widespread issue where deductors received tax notices for not applying the higher TDS rate mandated for unlinked PANs. This blog details the conditions of this relief as per CBDT Circular No. 9/2025, outlines the crucial deadlines like September 30, 2025, and explains the actionable steps for both deductors and deductees to benefit from this waiver and ensure future compliance.

.jpg)

Breaking Relief: CBDT Eases Higher TDS/TCS Burden for Inoperative PANs (Circular No. 9/2025)

This blog post explains the important relief offered by CBDT Circular No. 9/2025, dated July 22, 2025, about higher TDS/TCS rates for transactions with inoperative PANs. It describes how deductors and collectors will not be held responsible for short deductions or collections if the deductee's or collectee's PAN is made operative within certain time frames, specifically by September 30, 2025, for past transactions and within two months from the end of the month for future ones. The summary underscores the circular's importance in tackling taxpayer complaints, easing the compliance load, and encouraging PAN-Aadhaar linkage. It urges readers to grasp the new rules and take action quickly.

.jpg)

Taxpayer Alert! Decoding Income Tax Department's New Rules for FY 2025-26

The Income Tax Department is making significant updates and tightening compliance for FY 2025-26 (AY 2026-27). This blog post serves as an important "taxpayer alert." It explains key changes, such as the mandatory Aadhaar-based verification for updates to the e-filing portal and PAN applications. There is also a stronger emphasis on computer-assisted scrutiny (CASS) for certain types of returns, including survey/search cases, ITR-7 filers, recurring additions, and intelligence alerts. Additionally, it provides information on expected delays in ITR refunds due to outstanding demands and technical upgrades. The focus on HRA claims will tighten, especially those that involve family members. It highlights the need for proactive compliance, careful record-keeping, and timely responses to avoid penalties and ensure a smooth tax experience.