# 2025

12 posts in `2025` tag

ITR E-Verification Made Easy: Your 2025 Guide Using Demat or Bank Account

A complete 2025 guide on how to e-verify your Income Tax Return (ITR) quickly and securely using your pre-validated Bank Account or Demat Account on the e-Filing portal. Learn the prerequisites and the step-by-step Electronic Verification Code (EVC) generation process.

Income Tax Return & Audit Report Deadlines Extended for AY 2025–26

The Central Board of Direct Taxes (CBDT) has extended the deadlines for filing Income Tax Returns and audit reports for the Assessment Year 2025–26. This move offers relief to taxpayers and professionals by giving them more time to complete their filings.

GST 2.0: Faster, Easier Registration for Startups and MSMEs from November 1

From November 1, 2025, small businesses and startups in India can benefit from a simplified GST registration process. This reform promises approval within 3 working days for low-risk applicants and public sector entities. It’s part of the broader GST 2.0 initiative aimed at making tax compliance faster, easier, and more tech-driven. Learn how this change can help you start your business with less hassle and more confidence.

DIR-3 KYC Deadline Extended to October 31, 2025 – No Late Fees

The Ministry of Corporate Affairs (MCA) has extended the DIR-3 KYC deadline to October 31, 2025. This allows directors to file without incurring the ₹5,000 late fee and avoid DIN deactivation. Learn who needs to file, which form to use, and why early action is crucial.

GSTN Clarifies: No Change in ITC Auto-Population from GSTR-2B to GSTR-3B

GSTN has issued a clarification confirming that the auto-population of Input Tax Credit (ITC) from GSTR-2B to GSTR-3B remains unchanged, even after the implementation of the Invoice Management System (IMS). GSTR-2B will continue to be generated automatically on the 14th of every month. This update helps clear confusion and reassures taxpayers that their filing process remains stable.

GST Appeals Made Easier: Lower Pre Deposit Rules Under Finance Act 2025

The Finance Act 2025 brings relief to businesses by reducing the pre-deposit requirement for penalty only GST appeals from 25% to 10%. Tax appeals remain unchanged at 10%. Businesses can now use Input Tax Credit (ITC) for deposits, improving cash flow and easing compliance. These changes will be effective after CBIC notification.

Provisional GST Refunds: Faster Relief for IDS-Affected Businesses

Starting October 1, 2025, businesses affected by inverted duty structure (IDS) can now receive 90% of their GST refund upfront. This move by CBIC aims to ease working capital pressure and improve cash flow for industries like textiles, footwear, and fertilizers. Learn how this change impacts your business and what steps you need to take.

Default Isn’t Always Best: How to Choose the Right Tax Regime in 2025–26

India's income tax system has undergone a major shift for FY 2025–26, with the New Tax Regime now set as the default. This blog breaks down the differences between the New and Old Regimes, compares tax slabs, and helps taxpayers decide which option suits them best. Whether you're a young professional or a seasoned investor, understanding these changes is key to smarter tax planning.

Faster Cheque Settlements: RBI’s Big Update from October 2025

The Reserve Bank of India is launching a faster cheque clearing system from October 4, 2025. Cheques will now be processed continuously throughout the day, reducing settlement time from 1–2 days to just a few hours. This change benefits both individuals and businesses by improving cash flow and reducing fraud risks.

GST Changes from October 2025: What You Need to Know

Starting October 2025, the GST system will undergo major changes affecting how businesses file returns and claim input tax credit. Key updates include manual ITC acceptance, locked GSTR-3B liabilities, new credit note rules, and invoice-level TDS reporting. Businesses must adapt to stay compliant and avoid filing issues.

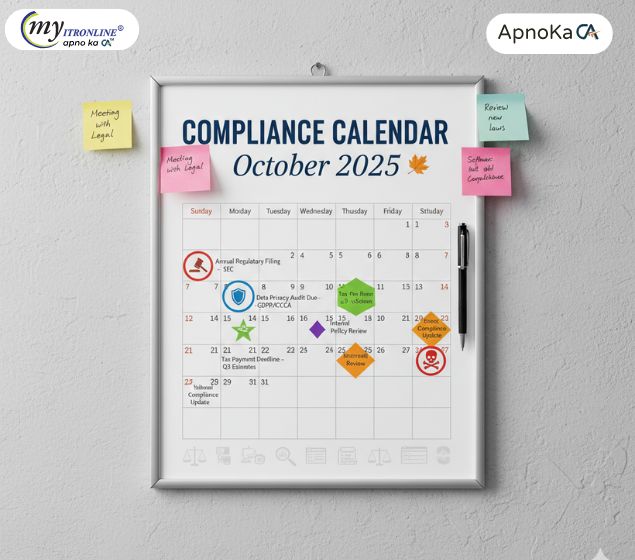

Compliance Calendar October 2025 – Key Tax and Regulatory Deadlines

October 2025 is packed with critical tax and regulatory deadlines. This blog highlights key dates for income tax, GST, MCA filings, EPF/ESI contributions, and audit-related submissions to help you stay compliant and avoid penalties.

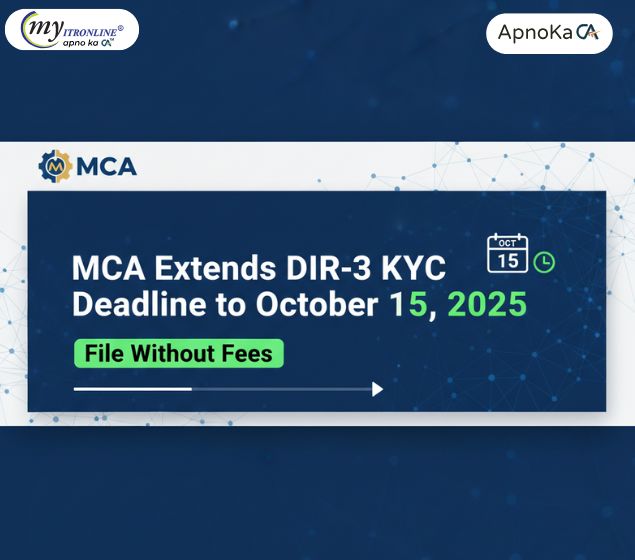

MCA Extends DIR-3 KYC Deadline to October 15, 2025 - File Without Fees

The Ministry of Corporate Affairs has extended the DIR-3 KYC filing deadline from September 30, 2025 to October 15, 2025, without any filing fees. This compliance requirement applies to all directors holding a DIN. Directors can file either DIR-3 KYC (with DSC) or DIR-3 KYC-WEB (OTP-based) forms. Non-compliance will result in DIN deactivation, penalties up to ₹5,000, and disqualification from director appointments. The extension follows stakeholder representations requesting additional time for compliance.