# 2024

12 posts in `2024` tag

How to File GSTR-9 for FY 2023-24 with Late Entries in FY 2024-25

Filing GSTR-9 for FY 2023-24 can be confusing if you recorded some entries in FY 2024-25. This guide shows where to report late ITC, missed sales/debit notes, credit notes, and reverse charge so your annual return is accurate.

Drive Electric, Save on Tax: A Simple Guide to Section 80EEB

A simple guide to Section 80EEB, explaining how individuals can save up to ₹1,50,000 annually on EV loan interest, eligibility rules, and how to claim the deduction under the old tax regime.

GST Annual Return Simplified: Key ITC Changes in GSTR-9 & GSTR-9C for FY 2024-25

A simplified guide to ITC changes in GSTR-9 and GSTR-9C for FY 2024-25, covering late claims, reversals, reclaims, and reconciliation requirements.

Key GSTR-9 Changes for FY 2024-25: Your Essential Compliance Guide

The GST landscape for FY 2024-25 sees major updates to GSTR-9 and GSTR-9C. This guide breaks down the structural changes, like the new Table 6A1 for prior-year ITC, revised deadlines, and enhanced reconciliation requirements, ensuring taxpayers stay compliant and avoid late fees.

Key Changes in GSTR-9 and GSTR-9C for FY 2024-25: Everything You Should Know

The GST portal has opened GSTR-9 and GSTR-9C for FY 2024-25 with a filing deadline of December 31, 2025. This guide explains the key changes in both forms, filing thresholds, auto-population details, and practical tips to file on time and avoid penalties—written in clear, simple language.

Refund Adjusted Against Outstanding Demand: What You Need to Know

If your income tax refund is adjusted against an old tax demand, it’s likely due to Section 245 of the Income Tax Act. This blog explains what the notice means, how to respond within 30 days, and what options you have. Learn how to protect your refund and keep your tax records clean.

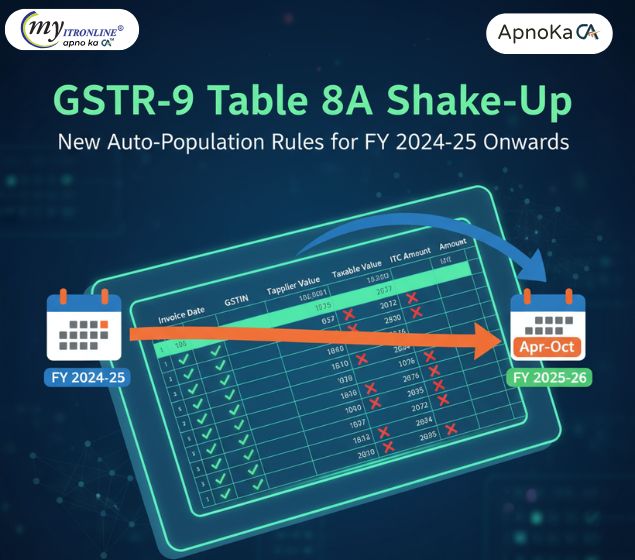

GSTR-9 Table 8A Shake-Up: New Auto-Population Rules for FY 2024-25

GSTN has changed how Table 8A in GSTR-9 is auto-filled. Starting FY 2024-25, it will include invoices from both the current and next financial year, making ITC reconciliation more accurate. Learn what’s included, what’s excluded, and how to prepare.

GSTR-9 and GSTR-9C Filing for FY 2024-25 is Now Open

The GST portal has enabled GSTR-9 and GSTR-9C forms for FY 2024-25 starting October 12, 2025. Taxpayers can now file their annual returns and reconciliation statements before the December 31 deadline. Learn who needs to file and how to prepare.

ICAI Eases Financial Reporting for Non-Corporate Entities & LLPs in FY 2024-25

The Institute of Chartered Accountants of India (ICAI) has announced a significant, temporary compliance relaxation for non-corporate entities and Limited Liability Partnerships (LLPs) for the Financial Year 2024-25. This allows these entities to optionally adopt updated guidance notes on financial statements, aiming to reduce administrative burden while maintaining transparency and accuracy. This flexibility ensures that core accounting standards remain paramount, offering businesses a choice in their reporting approach for the upcoming fiscal year.

Big News for Small Businesses: Say Goodbye to Annual GST Returns (GSTR-9) From FY 2024-25!

This blog post announces a significant and permanent change in GST compliance for small businesses in India. From Financial Year 2024-25, businesses with an annual aggregate turnover of up to 2 crore are exempt from filing the annual GST return (Form GSTR-9). The article details what changed, who benefits, and the tangible advantages like time and cost savings. It also highlights crucial reminders about continued monthly/quarterly filings, record-keeping, and turnover monitoring. The post emphasizes that this move will greatly enhance the "Ease of Doing Business" for millions of small enterprises.

Didn’t File ITR by September 16? Here’s What You Can Still Do

This blog post provides a comprehensive guide for individuals who have missed the September 16, 2025, deadline for filing their Income Tax Return (ITR) for FY 2024-25. It reassures readers that filing is still possible through a "belated return" by December 31, 2025, but outlines the associated penalties, including late filing fees (₹1,000 or ₹5,000) and interest on unpaid tax. The article also details other consequences of late filing, such as the inability to carry forward certain losses, delayed refunds, and potential loss of specific deductions. It touches on rare exceptions and what happens if even the belated deadline is missed. Finally, it offers practical advice to act promptly, gather documents, compute accurately, and seek professional help, promoting MyITROnline as a solution for simplified tax filing.

.jpg)

CBDT Instruction No. 01/2025 – Black Money Act Update for Minor Foreign Assets

The CBDT has issued Instruction No. 01/2025 on 18 August 2025, aligning its policy with the Finance (No. 2) Act, 2024. This update ensures that prosecution under Sections 49 and 50 of the Black Money Act will not be initiated for undisclosed non-immovable foreign assets valued up to ₹20 lakh. The move offers relief to genuine taxpayers, prevents harsh action for minor errors, and focuses enforcement on serious non-compliance cases.